Let’s face it, traveling can be a nerve-wrecking experience. There are so many uncertainty factors that can occur and leave you stranded in a very undesirable situation. As a diabetes patient, you have even more to worry about other than catching the next flight, hoping they have your diabetic meal ready, and praying that your luggage will safety arrive at the destination ready for pickup.

You have to worry about how to handle unforeseen health problems that may arise during flight or while you are at your destination. But worrying can only cause unwanted stress and fluctuation of your blood level. Instead of spending the time to worry, why don’t you spend the time to better plan and prepare for your trip.

Overview

In this article, we will discuss about why it is a great idea to invest in a travel insurance in the first place. We will explain how your current Medicare plan policies are extremely limited regarding to foreign location health coverage, and why your Medigap supplement plan is simply insufficient for traveling emergency expense needs. We will introduce you to a list of insurance companies that are willing to overlook diabetes as a pre-existing condition, and provide you with three best policy choices in our opinion.

And to help you lower your insurance cost, we have provided you with some alternative options and suggestions that may be overlooked. We hope that by providing you with various solutions, you will be looking at traveling and travel health insurance at a new angle.

Contents

Reasons to Buy Travel Insurance

One of the ways to ease your distress is to get yourself a travel insurance policy. By simply paying for the service ahead of time, you can end up saving a lot of money and easily resolve numerous traveling nightmares such as:

- You missed your flight or your flight has been canceled

- Your bags are lost and your medication is in it. You now need an emergency prescription

- Your wallet and passport are missing, and you need emergency cash and a replacement passport.

- You are in an accident and there is no adequate medical

- You need to cancel your trip due to illness, sudden emergency events or work complication

- Your cruise line, airline, or tour operator goes bankrupt, and you are stranded at your destination

- You have a medical emergency at your travel destination

- A terrorist attack occurs where you are planning to visit, and you wish to cancel your trip

- Sudden weather forces you to evacuate from your destination

I also recommend reading these related articles:

Do You Really Need Travel Health Insurance?

The answer is YES. For all the current Medicare diabetes patients who are not enrolled in Medigap Plans that cover foreign travel medical emergency services, Medicare will not pay for health care or supplies you get outside the United States.

The definition “outside of United States” means any place other than the 50 states of the United States, the District of Columbia, Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, and the Northern Mariana Islands. However, there are 3 exceptions to the rule that would allow you to receive coverage outside of United States under the Medicare Part A and Medicare Part B.

- You are in the United States when you have a medical emergency, and the foreign hospital is closer than the nearest United States hospital that can treat your illness or injury.

- You are traveling through Canada without unreasonable delay by the most direct route between Alaska and another state when a medical emergency occur, and the Canadian hospital is closer than the nearest United States hospital that can treat your illness or injury. Medicare determines what qualifies as “without unreasonable delay” on a case-by-case basis.

- You live in the United States and the foreign hospital is closer to your home than the nearest United States hospital that can treat your medical condition, regardless of whether it is an emergency.

And same as the policy applied to services in the United States, Medicare will only pay for the Medicare-covered services you receive in a foreign hospital. You will be responsible for any other treatments or medication you receive that are not covered by Medicare Part A and Part B.

Medigap Isn’t For Everyone

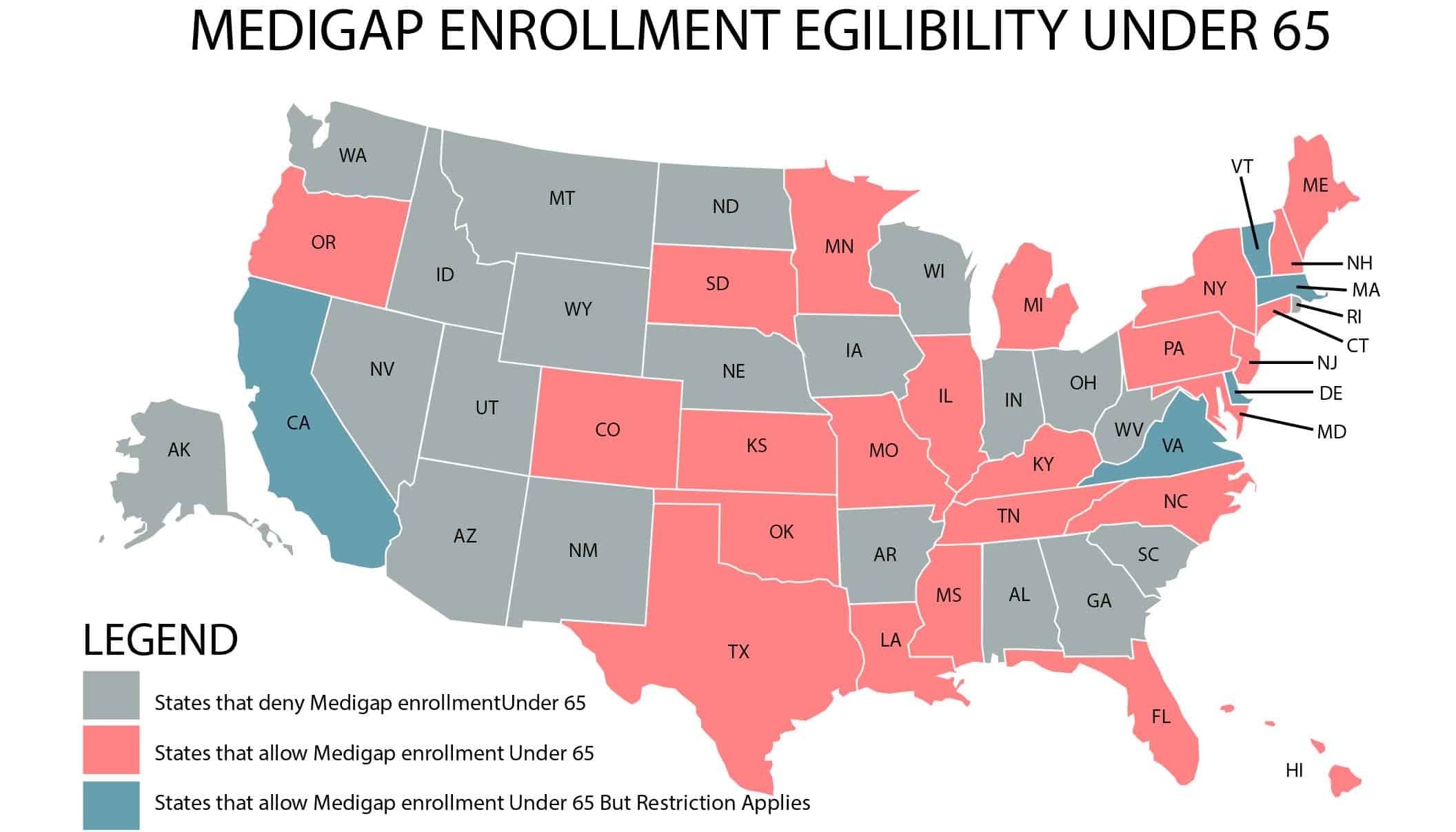

Medigap sounds like the perfect solution for securing a traveling insurance. However this standardized supplementary plan isn’t available to everyone. In some States, the law requires that you must be at least 65 years old to qualify for the supplement plan.

Other States has made it a legal right for you to obtain at least one kind of Medigap coverage before you reach age 65. Here is the list of the States that will allow the enrollment of Medigap (please note that there are specific restrictions to certain States):

- California (excluding those under 65 and with end-stage renal disease)

- Colorado

- Connecticut

- Delaware (only available to those with end-stage renal disease)

- Florida

- Georgia

- Hawaii

- Illinois

- Kansas

- Louisiana

- Maine

- Maryland

- Massachusetts (only available to those with end-stage renal disease)

- Michigan

- Minnesota

- Mississippi

- Missouri

- Montana

- New Hampshire

- New Jersey

- New York

- North Carolina

- Oklahoma

- Oregon

- Pennsylvania

- South Dakota

- Tennessee

- Texas

- Vermont (excluding those under 65 and with end-stage renal disease)

- Wisconsin

Depending on which Medigap Plan you have already enrolled in, you may be covered for any medical expense you have incurred in your travels.

An Overview of Medigap Plans

| Medigap Plans | ||||||||||

| A | B | C | D | F* | G | K | L | M | N | |

| Foreign Travel Exchange

(Up to Plan Limits) |

No | No | 80% | 80% | 80% | 80% | No | No | 80% | 80% |

The Medigap plans that includes foreign travel emergency service will pay 80% of the billed charged for covered services outside the United States after you meet a $250 deductible for the year. There is one exception; Plan F also offers a high-deductible plan.

If you choose this option, this means that you must pay for Medicare-covered costs up to the deductible amount of $2,180 in 2016 before your Medigap plan starts paying for anything. For all these Medigap plans, the foreign travel emergency coverage has a lifetime limit of $50,000.

Please note that if you live in Massachusetts, Minnesota, or Wisconsin, you have a different standardized Medigap policy.

- Massachusetts:

Massachusetts’s Supplement 1 Plan covers foreign travel emergency.

- Minnesota:

The basic Medigap plan will cover 80% of your foreign travel emergency expense. And the Extended Basic Medigap Plan will cover 80% of your foreign travel emergency expense until you reach the $1,000 out-of-pocket cost for the calendar year. Afterwards, the plan covers 100% your foreign travel emergency covered services expense.

- Wisconsin:

Plans known as "50% and 25% Cost-sharing Plans" are available. These plans are similar to standardized Plans K (50%) and L (25%). A high-deductible plan ($2,000) is also available. These policy will cover foreign travel emergency.

Lifetime Limit of $50,000 Is Not Enough

$50,000 really will not cover all the medical expenses should an emergency situation occurs. To give you a simple example, if you travel from California to British Columbia, Canada where you are faced with an emergency medical situation and require hospital care, one single night at the hospital will cost $100.

But with the medication and equipment use, you will need to pay much more than $100 per day depending on your needs. Instead of staying in Canada for the treatment, if you wish to fly home to California for the treatment, the special arrangement can easily be upward of $15,000.

This whole ordeal will quickly drain your lifetime limit and you will have to pay all the excess expense out of your own pocket. Afterward, you can never tap into the foreign travel emergency coverage ever again.

How does Pre-Existing Waiver Work?

Instead of relying solely on Medicare, there are many insurance companies that specialize in traveling insurance. Many will deny coverage for individuals with pre-existing conditions or exclude any claims related to the pre-existing condition.

But there are there are some companies that will cover medical expenses relative to your diabetic condition by offering a waiver. Depending on the insurance company, your pre-existing diabetes condition can be waivered if you fulfill these requirements:

- You must insure at least your trip’s full prepaid non-refundable cost (some companies do not require you to insure the full prepaid trip cost, but you still need to put down a deposit),

- Depending on the insurance company, you must get your policy within the limited days after you pay your earliest trip payment ,

- You must cover your trip’s full length, and

- You must be healthy enough and be able to take the trip on the set date. (If you insist on traveling against your doctor’s advice, the insurance company has the right to cancel your policy or refuse to cover your claims.)

Another factor you have to consider is the “Lookback Period” policy of the insurance company. In order to waive your pre-existing condition, you must have proof that your condition is “stable”. According to the policy definition, “stable” means that the person with the pre-existing condition has not already taken a turn for the worse, and not in a state where any changes are foreseen, known, or expected that could cause the person to “take a turn for the worse”. Depending on the company, the Lookback Period can be 60, 90, 180, or even 365 days prior to the travel insurance policy’s effective date.

According to the policy definition, “stable” means that the person with the pre-existing condition has not already taken a turn for the worse, and not in a state where any changes are foreseen, known, or expected that could cause the person to “take a turn for the worse”. Depending on the company, the Lookback Period can be 60, 90, 180, or even 365 days prior to the travel insurance policy’s effective date.

List of Insurance Policies that Includes Pre-Existing Waiver:

| Company | Plan Name | Pre-Existing Waiver Requirement |

| CSA Travel Protection | Custom Luxe | Must be purchased prior to or within 24-hours of final trip payment date |

| TravelSafe | Vacation Classic Plus with Cancel for Any Reason | Available if purchased within 21 days of initial deposit |

| TravelSafe | Vacation Classic | Available if purchased within 21 days of initial deposit |

| TravelSafe | Vacation Basic | Available if purchased within 21 days of initial deposit |

| RoamRight | Elite | Available if purchased within 21 days of initial deposit |

| RoamRight | Preferred | Available if purchased within 21 days of initial deposit |

| RoamRight | Essential | Available if purchased within 21 days of initial deposit |

| Travel Insured International | Worldwide Trip Protector | Available if purchased within 21 days of initial deposit |

| Travel Insured International | Worldwide Trip Protector Plus | Available if purchased within 21 days of initial deposit |

| Travel Insurance Service | Travel Select | Available if purchased within 21 days of initial deposit |

| Travel Insurance Service | Travel Max | Available if purchased within 21 days of initial deposit |

| Travel Guard | Cruise Tour and Travel | Available if purchased within 15 days of initial deposit |

| Travel Guard | Essential Expanded | Available if purchased within 15 days of initial deposit |

| Travel Guard | ProtectAssist | Available if purchased within 15 days of initial deposit |

| Travel Guard | Silver | Available if purchased within 15 days of initial deposit |

| Travel Guard | Gold | Available if purchased within 15 days of initial deposit |

| Travel Guard | Platinum | Available if purchased within 15 days of initial deposit |

| Global Alert | Preferred | Available if purchased within 15 days of initial deposit |

| Global Alert | Preferred Plus | Available if purchased within 15 days of initial deposit |

| MH Ross | Bridge | Available if purchased within 15 days of initial deposit |

| MH Ross | Complete | Available if purchased within 15 days of initial deposit |

| Travelex | Travel Max | Available if purchased within 30 days of initial deposit |

| HTH TripProtector | Classic | Available if purchased within 21 days of initial deposit |

| HTH TripProtector | Preferred | Available if purchased within 15 days of initial deposit |

TheDiabetesCouncil Top 3 Choices For Travel Insurance

#1 Top Choice: CSA Travel Protection Custom Luxe

The company will waive the pre-existing conditions provided that you meet the following requirements:

- Coverage is purchased prior to or within 24 hours of your final trip payment,

- You are medically and physically able to travel at the time the coverage is purchased, and

- You insure 100% of your prepaid trip costs that are subject to cancellation penalties or restrictions

CSA Travel Protection is easily the top choice as they are the only traveling insurance company that allows the purchase of a policy within 24-hour of final trip payment date. Even though the company requires that you have to pre-insure your trip cost in case of trip interruption (their trip interruption coverage is 175% of trip cost), you can claim the cost as $0 if you are willing to go without cancellation or trip interruption coverage. If you do decide to purchase the policy ahead of time, you have a 10 day free look period. Should you find a better policy elsewhere, they are happy to refund your money. Besides that, CSA has two unique features. The first being the maximum trip length as 356 days. Second, they have a 24-hr hotline with a stand-by doctor to answer your questions and concern. Should an emergency situation occur, you are always a phone call away from assistance. The only drawback of CSA Travel Protection is that they have a very limited selection of policies, and their Lookback Period is 180 days.

#2 Second Choice: HTH TripProtector Preferred

The HTH TripProtector Company will waive the pre-existing conditions provided that you:

- Purchase the policy within 21 calendar days after your initial trip deposit date,

- Insure your trip’s full prepaid, non-refundable cost, and

- You are medically able to travel at the date of the trip

HTH TripProtector Preferred is the second runner-up in our selection. Although you are required to purchase a policy within 21 days after your initial trip deposit date, HTH offers many advantages. The first big selling point is that their policy will accept up to $100,000 for pre-existing condition coverage and $500,000 for Secondary Emergency Medical coverage. Another big selling point is that their Lookback Period for pre-existing conditions is only 60 days. Unlike many other insurance companies, HTH will cover trips to Cuba.

#3 Third Choice: MH Ross Complete

The MH Ross Company will waive the pre-existing conditions provided that you:

- Purchase the policy within 15 calendar days after your initial trip deposit date,

- Insure part of your full prepaid trip cost as set by the company policy, and

- You are medically able to travel at the date of the trip

Similar to HTH TripProtector, MH Ross Complete policy will accept up to $100,000 for pre-existing condition coverage and has a Lookback Period of only 60 days. But unlike the first and second choices, the MH Ross Company does not require you to insure the full prepaid trip cost but only a percentage of the cost. At the same time, they offer an option of advance payment to a hospital to secure your admission in case of emergency.

This is a great policy for busy working individuals as cancellation due to work reasons coverage is included. The downside for this policy is that there is no lower price for children coverage. So if your child is the diabetic patient who requires the waiver, you will have to pay full price for his or her coverage.

| Purchase Deadline | Lookback Period | Payment | Pro | Cons | |

| CSA Travel Protection Custom Luxe | 24 hrs | 180 days | Full prepaid, non-refundable trip cost |

|

|

| HTH TripProtector Preferred | 21 days | 60 days | Full prepaid, non-refundable trip cost |

|

|

| MH Ross Complete | 15 days | 60 days | Partial percentage of full prepaid, non-refundable trip cost |

|

|

What Other Options Do I Have?

Depending on where you are traveling, choosing to purchase a traveling insurance policy at your travel destination may be cheaper and “friendlier”. For example, Canada Manulife CoverMe Travel Insurance allows coverage of diabetic patients provided that their condition is stable in the 180 days before the effective date of insurance. As stated in their policy, changing in medication brands and routine adjustment of insulin dosage are allowed as long as the prescriptions are not newly prescribed or stopped.

There are a few companies in the UK that will provide similar policies as well. However, if you do choose to go with this option, make sure you plan and purchase ahead of time as some policies will require a 24 hour activation period in which the company is not obligated to cover you should any emergency event occurs.

Another option to explore is to ask your credit card companies about any insurance policies included with your Visa or Mastercard. For some credit card companies, members will have free enrollment to traveling insurance policy should they purchase the trip on their credit card.

This will include cancellation of the ticket, rebooking of flight, lost luggage expenses, and even luggage replacement. With added purchase, health insurance may be included as well. This way, you can purchase a lower coverage waiver policy and only use it for your diabetes emergency needs.

Enjoy your Trip

Your trip should be filled with great memories of fun. By doing your research early on and paying for a traveling health insurance policy, you will have a much better control of any unplanned situations. While you are choosing the right plan, remember to read the policy thoroughly and make sure you are reading the correct State policy.

At the same time, ask lots of questions from different sources. By knowing the policy details, you can plan ahead what to do should specific health problem arises. This way, you can take the best advantage of your coverage without having to pay out of your own pocket for unnecessary expenses.

Please post any further suggestions for articles down below in the comments section.

TheDiabetesCouncil Article | Reviewed by Dr. Sergii Vasyliuk MD on June 02, 2020